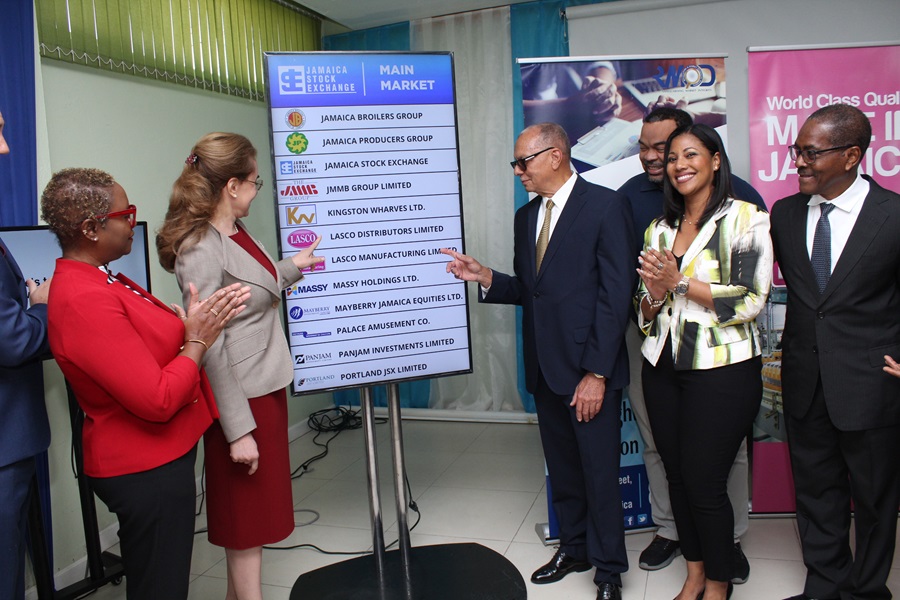

LASCO Distributor and Manufacturing migrated to the JSE Main Market on Wednesday, March 27, 2024. Both companies will now leave their home after thirteen years on the JSE Junior market to take up residence on the JSE Main Market. Prior to today’s migration of LASCO Distributor and Manufacturing, four other companies have migrated to the main market and are still performing well. LASCO Distributor and LASCO Manufacturing had successful IPOs, which were both oversubscribed by 153% and 136% respectively, and the companies raised $160.97 million and $195.79 million respectively.

According to Dr. Marlene Street Forrest, Managing Director of the Jamaca Stock Exchange (JSE), “Allow me to reflect a little on the success stories these companies represent to the shareholders and Jamaica. LASCO Distributor was listed at $2.50 with a market capitalization of $840 million. LASCO Manufacturing was also listed at $2.50 with a market capitalization of $1.02 billion. In 2013, the shareholders for both companies approved a 10 to 1 stock split; (for every one share split into 10 shares). Now the market capitalization for LASCO Distributor stands at $15.6 billion, an increase of 1,755% and the market capitalization for LASCO Manufacturing is $22.03 billion, an increase of 2,060% since listing. LASCO Distributor is currently trading at $4.42 per share and LASCO Manufacturing is trading at $5.33 per share.

The mobilization and utilization of equity capital is powerful and redounds to the growth and development of companies, but we also applaud and appreciate these companies and their management for the professional way in which they have navigated and upheld the rules of the Junior Market reflected in several awards they have received at the JSE Best Practices Awards. If past performance reflects future behaviour, I have no doubt that this will springboard these Companies into abiding by the rules of the Main Market and upholding good corporate governance standards”.

The Executive Chairman of LASCO Manufacturing and Distributor, Mr. James Rawle, speaking at the Migration Ceremony stated “LASCO Distributors revenue grew from $6.7B in 2012 to $26.5 billion in 2023, a fourfold increase over the period. While at LASCO Manufacturing the growth was from $3.0 billion in 2012 to $11.2 billion in 2023. Total Assets have grown from $2.3 billion in 2010 to $13.4 billion in 2023 a sixfold increase and LASCO Manufacturing from $1.1 billion to $13.7 billion a twelve-fold increase. The dividends paid to shareholders over the period is over $2 billion for LASCO Distributor and $2.35 billion for LASCO Manufacturing”. He went on to say that “the balance Sheets are strong as are Profitability ratios, Solvency and liquidity ratios. Direct staff employment has tripled over the period. LASCO Affiliated Group is well known for Corporate Social and outreach Programmes awards and recognition programmes for professionals in Health, Education and Security and for community support across the Island. The companies continue to invest in employee training, development and upskilling to meet emerging needs in the digital age”.

“The companies continue with targeted investments for growth – investments in technology (Enterprise Resource Planning ERP capabilities and software), automation and digital transformation to drive efficiencies. LASCO concentrates on building strong brands. We are investing for growth therefore, we are looking at a strong value creation strategy, to deliver sustainable profitable growth while maintaining affordability for our customers, this we call the value for money concept is primordial. The focus over the years has been on organic growth recognising the strength, relevance and resilience of the Brands recognising the unserved and underserved areas in the country. Organic growth will continue to be our focus, while opportunities for inorganic expansion where there may be strategic fit are looked at”. The Chairman told the audience.

Mr. Gary Peart, CEO of Mayberry Investments told the audience, that as the Broker that brought the three LASCO companies to Market, they did it through a lot of challenges, as in 2010 the market was just launched and there was a lot of convincing to be done for companies to be listed on the market. He went on to say that LASCO was no different, however, when Mr. Lascelles Chin heard the benefits of being listed he had no hesitation and the eight LASCO companies were amalgamated into 3 companies and listed on the Board of the Junior Market in October 2010.

—30—

CONTACT:

JAMAICA STOCK EXCHANGE

TEL: (876) 967-3271/322-0984: